Solutions

Best in class Investment Solutions offered through PFS Investment Inc.

Mutual Funds

- American Century Investments

- American Funds

- Fidelity Advisors

- Franklin Templeton Investments

- Invesco

- MFS

- Putnam Investments

Annuities

- AIG

- Brighthouse Financial

- Equitable

- Lincoln Financial

529 Plans

- American Funds

- Fidelity Investments

- Franklin Templeton Investments

- Scholar’s Choice

401(k) Plans

- Aspire

- Equitable

- American Funds

- CUNA Mutual

- Fidelity Advisors

- Voya

- July Services Managed Account 401k and Solok

- July Services Cash Balance Plans

LIFETIME INVESTMENT PROGRAM

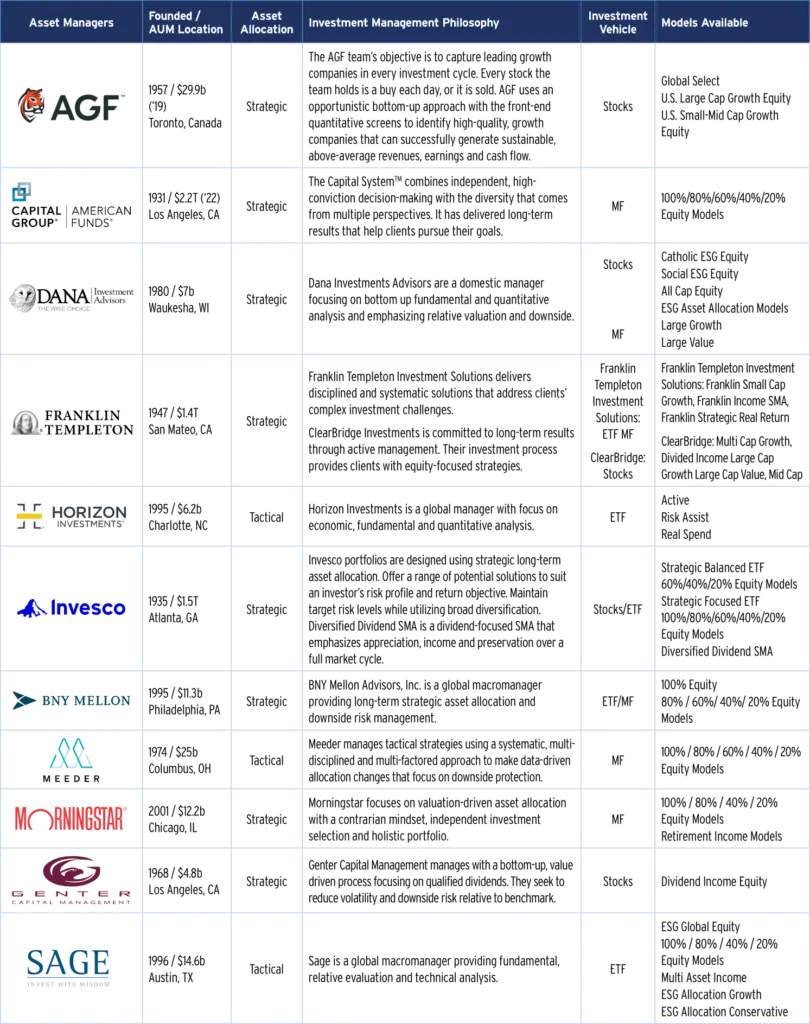

Equity Offerings

LIFETIME INVESTMENT PROGRAM

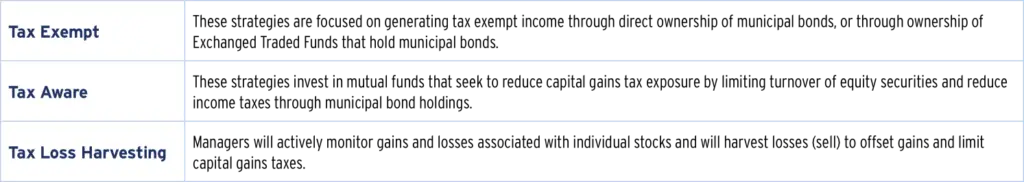

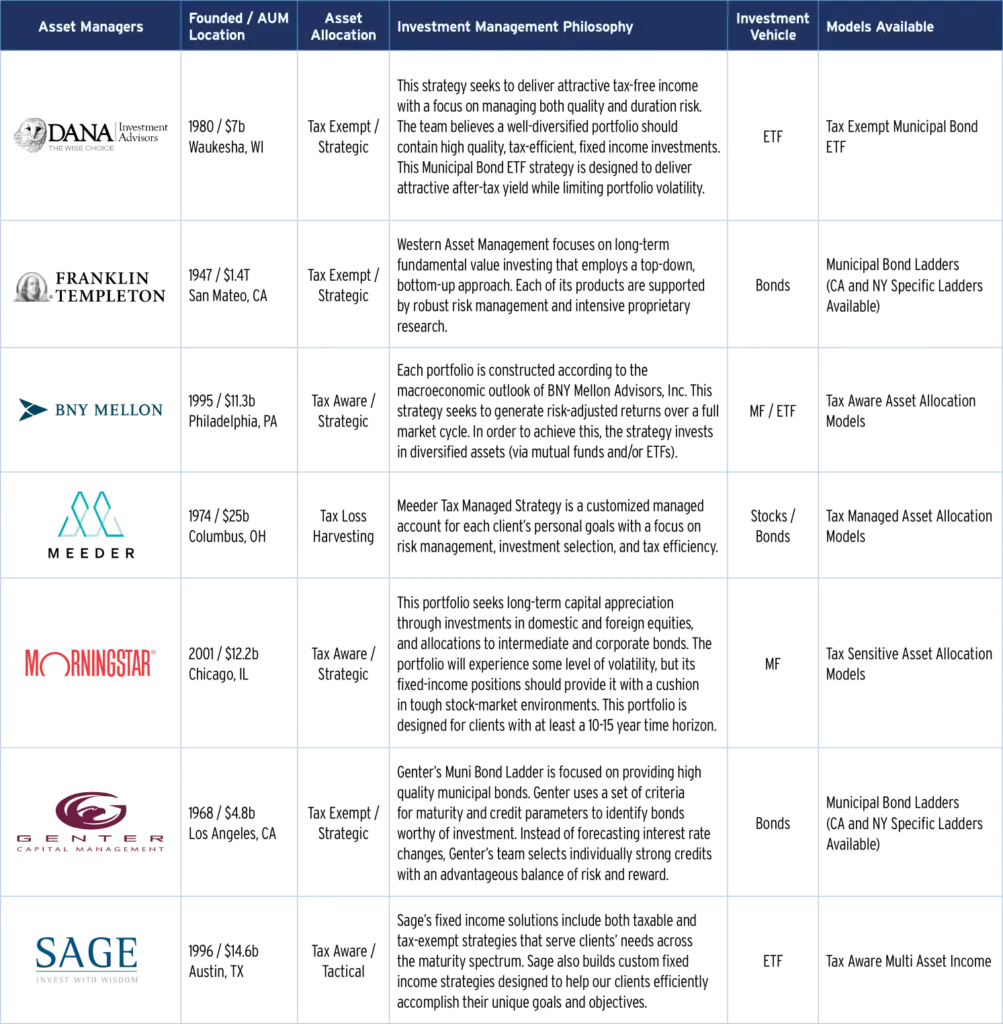

Tax Managed Offerings

These descriptions are the types of Tax-Managed Offerings Available.

These offerings are available for Non-Qualified Account Registrations.

Tax-Exempt

These strategies are focused on generating tax-exempt income through direct ownership of municipal bonds, or through ownership of Exchanged Traded Funds that hold municipal bonds.

Tax Aware

These strategies invest in mutual funds that seek to reduce capital gains tax exposure by limiting turnover of equity securities and reduce income taxes through municipal bond holdings.

Tax Loss Harvesting

Managers will actively monitor gains and losses associated with individual stocks and will harvest losses (sell) to offset gains and limit capital gains taxes.

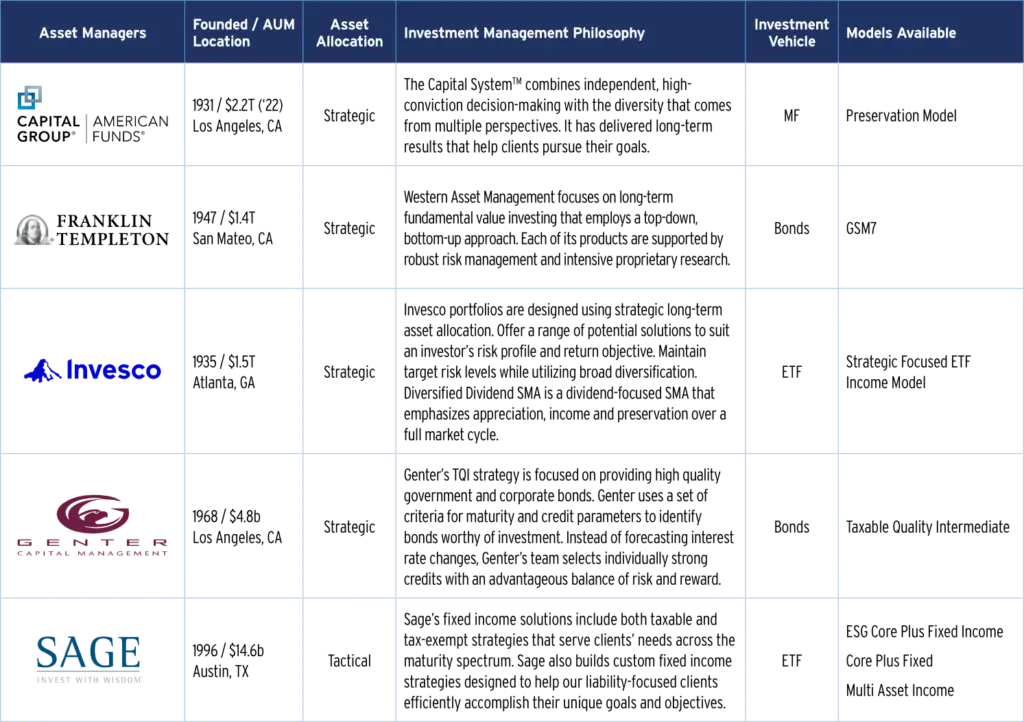

LIFETIME INVESTMENT PROGRAM

Taxable Fixed Income Offerings

PFS Investments Inc. (PFSI) offers both brokerage and advisory accounts. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available in brokerage and advisory accounts, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

Before investing, please review a copy of the Primerica Advisors Lifetime Investment Program Form ADV Part 2A wrap fee program brochure for a full description of the services offered by the program and the fees you will pay to receive those services.

The due diligence conducted by Primerica Advisors is not a guarantee that any asset manager, investment model, security, or investment style will provide positive performance over time.

It is important to remember that there are risks inherent in any investment, and that investments in the program are subject to multiple risks, including market, credit, interest rate, default, liquidity, currency, economic, and political risk. Investments in the program are not insured and may lose value. There is no guarantee that an investment in the program will achieve your investment objectives.

Diversification and asset allocation do not guarantee a profit or protect against a loss in declining markets.

The statements contained herein are based upon the opinions of Primerica Advisors and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any asset allocation strategy will be met. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Primerica Advisors to buy or sell any securities or investments.

PFS Investments Inc. (PFSI), 1 Primerica Parkway, Duluth, Georgia 30099-0001, registered broker-dealer and investment adviser, member of FINRA/SIPC. PFSI offers advisory services through and is the sponsor of the Primerica Advisors Lifetime Investment Program, a wrap fee program. Primerica Brokerage Services, Inc. (PBSI), member of FINRA/SIPC, is the provider of brokerage services for the Primerica Advisors Lifetime Investment Program. Representatives who offer advisory services are supervised persons of PFSI. Primerica, Inc., PFSI and PBSI are affiliated companies.

Your advisor does not have discretion to change the models held in your Lifetime Investment Program account, or to buy or sell individual securities in the account.

Tax considerations, while important, are one factor to consider before making any investment decision. Primerica Advisors is not a tax advisor, and neither Primerica Advisors nor its representatives provide tax advice. For specific tax advice, please consult with a qualified tax professional.

The securities used to construct the models available in the Lifetime Investment Program are not available through PFS Investments Inc.’s broker-dealer business.

The individuals identified as MBSJ Financial Group are affiliated with Primerica, and offer products and services through Primerica subsidiaries, including Primerica Life Insurance Company and PFS Investments Inc.

A Primerica representative’s ability to offer products and services is based on the licenses held by the individual, and the states in which the individual is registered. Not all representatives are authorized to sell all products and services. For additional information about a representative, including licenses and state registrations, please visit www.BrokerCheck.com.

PFS Investments Inc. (PFSI) offers both brokerage and advisory accounts. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available in brokerage and advisory accounts, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

Securities offered by PFS Investments Inc. (PFSI), 1 Primerica Parkway, Duluth, Georgia 30099-0001, a broker-dealer and investment adviser registered with the Securities & Exchange Commission (SEC), a member of the Financial Regulatory Authority (FINRA) [www.finra.org] and a member of the Securities Investors Protection Corporation (SIPC) [www.sipc.com]. PFSI’s advisory business is conducted under the name Primerica Advisors. Fixed indexed annuities are offered by Primerica Financial Services, LLC (PFS). PFSI, PFS and Primerica Inc. are affiliated companies.

The Lifetime Investment Platform is an advisory program sponsored by Primerica Advisors. For additional information about Primerica Advisors, please ask your representative for a copy of the Lifetime Investment Platform Form ADV brochure.

Investors should carefully consider the investment objectives, risks, charges, fees and expenses of any mutual fund before investing. This and other important information can be found in the fund’s prospectus and, if available, the summary prospectus. Please read the prospectus and, if available, the summary prospectus carefully before investing. Prospectuses are available from your Primerica representative.

Primerica representatives are not financial or estate planners, or tax advisors. For related advice, individuals should consult an appropriately licensed professional.

This material is for informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold a security.

Investing entails risk including loss of principal. Past performance is no guarantee of future results.